- home

- Corporate Governance

- Corporate Governance Report

Corporate Governance Report

The corporate governance of Mebuki Financial Group, Inc. (hereafter referred to as “the Company” or “we” and “the Group” consisting of the Company together with its consolidated subsidiaries) is described below.

Ⅰ Our Basic Corporate Governance Policy, Basic Information on Capital Structure, Corporate Attribution, and Other Basic Information

1. Basic Approach

1. Basic Approach

The Company will secure the development of responsible management system and sound operation of the Group’s businesses, to gain the creditworthiness from all stakeholders, including shareholders, customers, employees and local communities, and will increase corporate value creating a corporate governance structure with basic approach as follows :

- (1)The Company will secure the shareholders’ rights and equality.

- (2)The Company will create appropriate collaboration with stakeholders including shareholders, in consideration with their interests.

- (3)The Company will secure appropriate information disclosure and transparency.

- (4)The Company will secure the transparent, fair, prompt and decisive decision-making function through the Board of Directors, while ensuring the solid audit and supervisory function by the outside directors.

- (5)The Company will work toward constructive dialogue with shareholders directed at a sustainable growth and increasing corporate value over the medium to long term.

Reasons for non-compliance with the principles of corporate governance code

The Company complies with all principles of the Corporate Governance Code revised in June 2021 (including the principles applied to Prime listed companies).

Disclosure Based on the Principles of the Corporate Governance Code

[Principle 1.4] (Strategic Shareholdings)

Regarding basic policy on strategic shareholdings and exercising of voting rights, we have established in Article 7 of the “Corporate Governance Policy”. It is available on our website at (https://www.mebuki-fg.co.jp/eng/company/governance/)

○Status of efforts for reducing the number and balance of strategic shareholdings

The subsidiary banks that hold strategic shareholdings make efforts to reduce strategic shareholdings, taking into consideration the risk reduction and capital efficiency based on its economic rationale.

The Company announced our reduction target, “Reduction of 30.0 billion yen by the end of March 2028, compared to the end of March 2023,” (announced in May 2023). In the fiscal year ended March 31, 2025, strategic shareholdings (*) decreased by 11.7 billion yen (percentage to consolidated net assets of 14.4%). This is due to the reduction of 35 issues (companies) with a market value of 30.2 billion yen over the two years since setting the reduction target, while the market value increased by 18.4 billion yen due to the rise in stock prices. To achieve our reduction target, we will continue to reduce them while maintaining sufficient dialogue with our business partners.

| End of FY2021 (result) |

End of FY2022 (result) |

End of FY2023 (result) |

End of FY2024 (result) |

Compared to end of FY2023 | End of FY2027 (target) |

Compared to end of FY2022 | |

|---|---|---|---|---|---|---|---|

| Balance (including deemed shares held,billion of yen) | 191.9 | 150.9 | 164.7 | 139.2 | -11.7 | 120.9 | -30.0 |

| Percentage of consolidated net assets (%) | 20.0% | 16.6% | 16.6% | 14.4% | -2.2pt | ― | ― |

(※)Figures are fair value of strategic shareholdings (including listed and non-listed stocks) held by Joyo Bank, which holds more than two-thirds of stock owned by Mebuki FG and its subsidiaries (including deemed shares held).

○Assessing the rationality of strategic shareholdings

The Company examines each strategic shareholding (of listed companies) held by the subsidiary banks annually for their significance and economic rationale, and the results of examination as of March 31, 2025, is as follows:

- We hold shares aimed for sustainable growth and medium to long term enhancement of corporate value of the Group and customers or building stable business relationships with those customers, upon the examination of the medium to long term economic rationale and future outlook of shareholdings taking into consideration the associated risks and returns.

- We examine each shareholding for economic rationale from the viewpoint of profitability, creditworthiness, regional characteristics (relevancy to our core business area), and improvement of business relationship, etc. Concerning profitability, we examine their overall business RORA(※) based on our ROE target.

(※) overall business RORA = (Net interest margin on loans and deposits – Expenses (including credit cost) + Fees and Commissions + Dividends) ÷ Risk-weighted Assets (Loans and Stocks) - As of March 31, 2025, the Board of Directors confirmed every strategic shareholding to be meaningful pursuant to the basic policy to secure sustainable growth, increase corporate value over the medium to long term of the Group and issuing companies, and build stable business relationships with those companies. However, in the verification of profitability, we have established a policy to reduce those holdings that are deemed to lack rationality after sufficient dialogue with the investee companies.

[Principle 1.7] (Related Party Transactions)

When the Company engages in transactions with its directors or principal shareholders, in order to ensure that such transactions do not harm the interests of the Company or the common interests of our shareholders and prevent any concerns with respect to such harm, we have established the following procedures:

- When directors engage in transactions in the same line of business of the Company or transactions involving conflict of interest, the relevant transactions shall be approved by the Board of Directors.

- When the Company shall conduct transactions under unordinary terms and conditions with our subsidiaries or principal shareholders (who hold 10% or more of shareholder voting rights of the Company directly or indirectly), the relevant transactions shall be approved by the Board of Directors.

[Supplementary Principle 2.4.1]

- (1)Approach to Ensure Diversity

In order for an organization to fully demonstrate its creativity and grow, it is essential to respect and utilize the diversity of individuals. In our corporate ethics, we have stipulated “The Group will realize the work-style reform that respects diversity, individuality and personality of employees”. As the business environment changes rapidly, it is more important that we accept diverse human resources and values, provide working opportunities, and utilize them in our corporate activities more than before, in order to respond flexibly to the changes in society and customers’ needs. By creating an environment that diverse human resources can work actively regardless of age and gender, we will strengthen our organizational power, improve our corporate value and realize sustainable management,allowing us to contribute to the regional growth and development.- (2)

Goals for Promoting Female, Foreign and Mid-career Employees to Managerial Position and Implementation Status

Since the majority of employees of the Group are in Joyo Bank and Ashikaga Bank as core subsidiaries, “Voluntary and Measurable Goals” are set by the sum of the two banks.

(a) Female Employees

We are promoting our initiatives through setting the following target to expand the talent pool of future female executive candidates and continuous promotion of them. As a result of actively promoting capable and motivated female employees to higher positions, we have achieved the goal set in the Third Medium-Term Group Business Plan (as of end of March 2025: 35% or more) one year ahead of schedule, and as of the end of fiscal year 2024, the ratio has progressed to 36.6%. In the Fourth Medium-Term Group Business Plan (fiscal years 2025 to 2027), we will strengthen our efforts by setting the "female employee ratio in manager positions or higher" (27% or more by the end of March 2028) as a main KPI, in order to foster and promote female employees who can take on positions closer to the management level.Current Target Target Period Female employee ratio in assistant manager positions or higher 36.6% (as of Mar 31, 2025, +1.4pt compared to previous year) 35% or more end of March 2025 Female employee ratio in manager positions or higher 22.9% (as of Mar 31, 2025, +1.3pt compared to previous year) 27% or more end of March 2028 -

※The Company has disclosed the initiatives under the Act on Promotion of Women’s Participation and Advancement in the Workplace at our two subsidiary banks on our website.

(https://www.mebuki-fg.co.jp/eng/esg/society/)(b) Foreign Employees

We are engaged in recruiting people regardless of nationality and foreign employees are proactively working in the Group. Since the Company is a regional financial institution conducting our main business domestically, we only have a small number of foreign employees, and currently do not have a target for the promotion of foreign employees to managerial positions. However, it is essential to secure human resources who can be active globally, in order to support proactively the local needs for overseas business activities. We will continue to recruit foreign employees and develop a system in which diverse people, including foreign employees, can work actively in the environment best suited to them.(c) Mid-career Recruitment

We are also actively engaged in recruiting external human resources who are ready to operate in various fields including specialized fields. Whether mid-career recruitment or not, we are proactively promoting motivated and competent employees. Currently, the number of mid-career employees in assistant manager positions or higher is 270 people (7.3% of all employees in the same position, as of March 31, 2025). Under the above policy, we will continue to aim for further improvement.- (3)

Approach to Human Resources Development, Internal Environment Development and Implementation Status to Ensure Diversity

We are promoting to develop human resources so that they can aim to build their career fairly, regardless of age, gender, etc., and create an environment where employees can work for a long time. Therefore, we have pursued various measures such as initiatives based on the Act on Promotion of Women’s Participation and Advancement in the Workplace and “Work-style Reform”. We have established the “Diversity Promotion Office” as an organization to supervise the initiatives for promoting diversity in each personnel division of the two subsidiary banks and we will strengthen and accelerate our initiatives to practice diversity and improve the environment, based on the Group Diversity Policy.

(a) Developing System for Fair Career Advancement Regardless of Age, Gender, etc., and Support for Improving Employees’ Skills

We are conducting a wide range of career management training for regular employees who have reached a certain position. Based on their positions, we are promoting to raise awareness of career advancement and improve management capability. We are also enhancing to improve employees’ skills through various training programs for each business. Furthermore, we are developing a system to properly compensate active employees regardless of age, gender, etc.(b) Human Resources Development for Promoting Female Employees to Higher Positions

From FY2018, the two banks have jointly continued to hold “Mebuki Women’s Class” to foster future female leaders for those recently promoted to managerial positions. Further, each bank set an opportunity to acquire management skills mainly through their training by rank.(c) Development of a Working Environment where Employees can Work Easily and Actively in the Long Term

In order that diverse people can work actively in the long term in the Group, we are developing a pleasant working environment and improving various systems. Continuously, we will implement necessary review and enhancement in order to respond to changes in lifestyles and awareness toward working.

- Conducting seminars for employees returning to the workplace from childcare leave

- Leave system due to transfer of one’s spouse, commuting from own home system

- Flexible work system, work-interval system

- Setting days to go home early, latest time to leave the office

- Work-at-home (mobile working) system

- Expansion of leave system (self-care leave, wellness leave, etc.)

- Introduction of a side job system

- Expansion of support systems for balancing work with childbirth, childcare, etc.

[Principle 2.6] (Roles of Corporate Pension Funds as Asset Owners)

Our core subsidiaries, The Joyo Bank, Ltd.(hereafter referred to as “Joyo Bank”) and The Ashikaga Bank, Ltd.(hereafter referred to as “Ashikaga Bank”) have established each corporate pension fund. At the two banks, in order to demonstrate the expected functions as an asset owner, staffs with expertise in asset management are allocated at the secretariat. Furthermore, in the asset management committee, consisting of members familiar with asset management and pension fund in each department of market trading, risk management, corporate management and personnel, regular meetings are held to deliberate on basic policy for management and evaluation of the managing trustee organization, etc., enabling establishment of a framework to realize stable asset building for the participants/beneficiaries in the corporate pension plan and appropriate management of pension finance. In addition, each pension fund announced it would adopt the Principles for Responsible Institutional Investors (Japan's Stewardship Code).

With regards to preventing conflict of interest between the Company and beneficiaries of the funds, we shall ensure that it is managed appropriately as provided in the fund regulations preventing any act to harm fair fund management and investment for the purpose of its own interests or those of third parties. In addition, the significant matters such as the change of regulations shall be referred to the representative conference consisting of one-half of members who are pension funds’ participants.[Principle 3.1] (Full Disclosure)

- (1)Under the Group philosophy of “providing high-quality comprehensive financial services to continue building a more prosperous future by together with local communities,” we will promote a sustainable growth together with local communities, with solid relationship of trust with local communities, by providing high-quality comprehensive financial services.

With aim to ensure the sustainable growth and improving our corporate value through the realization of the group philosophy, we have formulated medium-term group business plan as the basic strategies and the Group performance objectives.

For details, it is available on our website at (https://www.mebuki-fg.co.jp/eng/company/policy/) - (2)The Company has established “Corporate Governance Policy” that has defined basic corporate governance policy, framework and management policy.

It is available on our website at (https://www.mebuki-fg.co.jp/eng/company/governance/governance.html) - (3)For the policies and procedures for determining the compensation of directors, see Article 24 (Compensation of Directors) of the “Corporate Governance Policy” on our website and “Ⅱ 1. Matters Regarding Organizational Composition and Operation, Policy for Determining Compensation Amounts or Calculation Methods Thereof”of this report.

It is available on our website at (https://www.mebuki-fg.co.jp/eng/company/governance/governance.html) - (4)The policies and procedures for election and dismissal of directors have been stipulated in Article 14 (Composition of the Board of Directors), 16 (Election of Directors), 17 (Dismissal of Directors) and 20 (Composition of the Audit and Supervisory Committee) of “Corporate Governance Policy”.

It is available on our website at (https://www.mebuki-fg.co.jp/eng/company/governance/governance.html) - (5)See “Notice convocation of the ordinary general meeting of shareholders” for the reasons for being selected as candidates. And it is available on our website at (https://www.mebuki-fg.co.jp/eng/shareholder/stock/generalmeeting.html)

[Supplementary Principle 3.1.3]

See “Ⅲ 3. Measures for Respecting Stakeholders, Implementation of Environmental Activities, CSR Activities” of this report.

[Supplementary Principle 4.1.1] (Roles and Responsibilities of the Board (1))

The approach to decision-making on business execution matters that have to be determined solely by the Board of Directors, and scope of delegation to management have been stipulated in Article 13 (Roles and responsibilities of the Board of Directors) of “Corporate Governance Policy”.

And it is available on our website at (https://www.mebuki-fg.co.jp/eng/company/governance/governance.html)[Principle 4.8] (Effective Use of Independent Directors)

The Board of Directors shall have a balanced composition that shall provide a wealth of knowledge and expertise in wide range of fields and shall appoint two (2) or more independent outside directors, and the Company has appointed five (5) independent outside directors currently (Independent outside director ratio of all directors: 41.7%). The composition and election of the Board of Directors have been stipulated in Article 14 (Composition of the Board of Directors) and Article 16 (Election of Directors) of "Corporate Governance Policy".

And it is available on our website at (https://www.mebuki-fg.co.jp/eng/company/governance/governance.html)[Principle 4.9] (Independence Standards and Qualification for Independent Directors)

Independence Standards for Outside Directors of the Company has been stipulated in Footnote 5 of “Corporate Governance Policy”.

And it is available on our website at (https://www.mebuki-fg.co.jp/eng/company/governance/governance.html)[Supplementary Principle 4.10.1]

See“Ⅱ 1. Matters Regarding Organizational Composition and Operation, Voluntary Committees”.

[Supplementary Principle 4.11.1] (Preconditions for Board Effectiveness)

View on the balance of knowledge, experience and skills, diversity and size of the board of directors as a whole, the policies and procedures for the election of directors have been stipulated in Article 14 (Composition of the Board of Directors) and Article 16 (Election of Directors) of “Corporate Governance Policy”.

And it is available on our website at (https://www.mebuki-fg.co.jp/eng/company/governance/governance.html)

Please refer to “Reference documents for the general meeting of shareholders” of “Notice convocation of the 9th ordinary general meeting of shareholders”, which is available on our website, for the skills matrix containing a list of expertise and experience of current directors and executive officers.

(https://www.mebuki-fg.co.jp/eng/shareholder/stock/generalmeeting.html)[Supplementary Principle 4.11.2]

Please refer to “Reference documents for the general meeting of shareholders” of “Notice convocation of the 9th ordinary general meeting of shareholders”, which is available on our website, for significant concurrent positions.

(https://www.mebuki-fg.co.jp/eng/shareholder/stock/generalmeeting.html)[Supplementary Principle 4.11.3]

The Board of Directors of the Company conducts analysis and evaluation of its effectiveness as a whole each year, in order to utilize the results of such evaluation to improve the operations of the Board of Directors, by confirming the opinions of each director on such matters as the composition and operation of the Board of Directors. The summary of the evaluation of the Board of Directors for fiscal year 2024 is as follows:

<Evaluation Method>

Regarding the FY2024 evaluation, opinions were exchanged on the evaluation method and the contents of the questionnaire at the executive session comprising all outside directors of the Company and its subsidiary banks, as was the case in the previous fiscal year.

Based on this discussion, questionnaires on the composition and operations of the Board of Directors and other matters were distributed to all directors, and replies and comments were obtained. With regard to the results of the evaluations based on these replies and comments, the Board of Directors of the Company, upon deliberation by the Corporate Governance Committee (with outside directors accounting for the majority of its members), finalized and determined the results of analysis and evaluation of the effectiveness of the Board of Directors as a whole.(Main items of questionnaire about effectiveness of the Board of Directors as a whole)

- (1)Rules and responsibilities of the Board of Directors (each director)

- (2)Composition of the Board of Directors

- (3)Operation of the Board of Directors

- (4)Execution of function by the Board of Directors

(Schedule)

- Exchange of opinions in the Executive Session : November 7, 2024

- Questionnaire distribution : December 23, 2024 (deadline for response : January 10, 2025)

- Deliberation at the Corporate Governance Committee : February 25, 2025

- Deliberation (making-decision) at the Board of Directors : March 17, 2025

<Evaluation Results>

The Board of Directors of the Company has confirmed that directors with diverse knowledge and experience have been elected and the composition is well balanced; all directors, upon sharing the roles and responsibilities of the Board of Directors, have successfully fulfilled both decision-making and supervising functions while taking advantage of the perspective of independent outside directors; and thus the effectiveness of the Board of Directors as a whole has been mostly assured.

The issues identified in the previous evaluation and main efforts for improvement are as follows:- (1)Enhancement of discussions regarding medium-to long-term management issues and strengthening external communications

- Review and reorganization of medium- to long-term issues in line with the formulation of the next medium-term group business plan, and re-evaluation of materiality

- (2)Continued efforts towards further sharing of information among directors

- Sharing the status of important meetings of directly invested subsidiary companies and providing opportunities for outside directors to conduct on-site inspections and engage in dialogue with institutional investors

Additionally, in the fiscal year 2025, based on each director’s assessment and opinions, we recognized that it is necessary to continue working toward further improvement in the following matters:

- 1. “Further enhancement of discussions leveraging the diverse insights and expertise of directors”

- Conducting discussions regarding governance systems aimed at management practice based on diverse values and perspectives

- 2. “Continued efforts towards further sharing of information among directors”

- Further improvement of opportunities for sharing management information among Group companies

- Enhancing opportunities for information exchange between directors who are members of the Audit and Supervisory Committee and those who are not.

By implementing necessary measures to ensure the sustainable growth of the Group and further increase its corporate value in the medium- to long-term, our Group will strive to enhance the effectiveness of its corporate governance structure.

[Supplementary Principle 4.14.2] (Director Training)

The policy for directors training has been stipulated in Article 25 (Directors Training) of “Corporate Governance Policy”.

It is available on our website at (https://www.mebuki-fg.co.jp/eng/company/governance/governance.html)[Principle 5.1] (Policy for Constructive Dialogue with Shareholders)

The policies concerning measures and organizational structures aimed at promoting constructive dialogue with shareholders has been stipulated in Article 26 (Dialogue with shareholders and investors) of “Corporate Governance Policy”.

It is available on our website at (https://www.mebuki-fg.co.jp/eng/company/governance/governance.html)[Status of Dialogue with Shareholders] [Updated on November 27, 2025]

We endeavor to disclose corporate information in a timely and appropriate manner. Our focus extends to ensuring highly transparent corporate management through proactive IR activities and constructive dialogues with shareholders and investors in Japan and overseas.

Specifically, in addition to disclosing corporate information in a timely, fair, and accurate manner, our top management actively holds briefings on our business performance, conditions, strategies, and other pertinent factors to provide shareholders and investors with a deeper understanding of the Company.

For details, please refer to “Integrated Report (Annual Report)” which are available on our website.

(Japanese : URL https://www.mebuki-fg.co.jp/shareholder/ir_library/disclosure/)

(English : URL https://www.mebuki-fg.co.jp/eng/shareholder/ir_library/annual_report/)[Responding to Achieve Cost of Capital and Stock Price Conscious Management] [Updated on November 27, 2025]

Through the strategic development of the Fourth Medium-Term Group Business Plan, we aim to improve both economic value and social value, eliminate the negative equity spreads, and improve our PBR.

Specifically, we will focus on improving ROE, reducing cost of shareholders’ equity, and increasing expected growth rates.- Improvement of ROE (Target for FY2027: 9.0% or more) : We will promote improvement of RORA (target for FY2027: 1.0% or more) and appropriate financial leverage by strengthening high-RORA areas (individual and local corporate loans, and fees from customer services), as well as profitability enhancement in areas such as urban corporate loans, etc. Additionally, we will aim for appropriate reduction of OHR based on the expansion of gross business profit.

- Enhancement of Shareholder Returns and Capital Efficiency: We revised our shareholder return policy (targeting a dividend payout ratio of 40% or more by FY2027). And, we will steadily reduce strategic shareholdings.

- Improvement of Social Value : We will promote strategies to solve social issues, including support of the growth of local industries and contributions to a decarbonized society and environmental conservation.

- Strengthening of Management Base Resilience : We will enhance DX initiatives (cumulative strategic DX investments of 14.0 billion yen) and human capital investments (cumulative 3.0 billion yen).

For details on our efforts to improve corporate value, please refer to pages 20 to 41 of the "Financial Results for the First Half of FY2025 (IR Presentation)". It is available on our website at (https://www.mebuki-fg.co.jp/eng/shareholder/ir_library/results/)

2. Capital Structure

Foreign shareholding ratio Over 20% and less than 30% Status of Major Shareholders

Name / Company Name Number of Shares Owned

(Shares)Shareholding Ratio (%) The Master Trust Bank of Japan, Ltd. (Trust Account) 138,637,900 14.08 Custody Bank of Japan, Ltd. (Trust Account) 61,783,300 6.27 Nippon Life Insurance Company 27,590,229 2.80 Sumitomo Life Insurance Company 21,659,760 2.20 Sompo Japan Insurance Inc. 19,261,260 1.95 STATE STREET BANK AND TRUST COMPANY 505001 18,303,470 1.85 STATE STREET BANK AND TRUST COMPANY 505103 16,325,879 1.65 Meiji Yasuda Life Insurance Company 15,864,808 1.61 BNY GCM CLIENT ACCOUNT JPRD AC ISG (FE-AC) 14,991,154 1.52 STATE STREET BANK AND TRUST COMPANY 505223 14,419,237 1.46 Controlling Shareholder (except for Parent) - Parent None Supplementary Explanation

The above major shareholders are as of March 31, 2025.

Shareholding ratio is calculated based on the total number of shares issued less treasury stock and the figures are rounded down to the second decimal place.3. Corporate Attributes

Listed Stock Market and Market Section Tokyo Stock Exchange, Prime Market Fiscal Year-End March Type of Business Bank Number of Employees (Consolidated) at End of the Previous Fiscal Year More than 1,000 Net Sales (Consolidated) for the Previous Fiscal Year From ¥100 billion to less than ¥1 trillion Number of Consolidated Subsidiaries at End of the Previous Fiscal Year From 10 to less than 50 4. Policy for Measures to Protect Minority Shareholders in Conducting Transactions with Controlling Shareholder

---

5. Special Circumstances which may have Material Impact on Corporate Governance

---

Ⅱ Status of Business Management Organization and Other Corporate Governance Structure regarding Decision-making, Execution of Business, and Supervision

1. Matters Regarding Organizational Composition and Operation

Form of Organization Company with an Audit and Supervisory Committee Directors

Number of Directors Stipulated in Articles of Incorporation 12 Term of Office Stipulated in Articles of Incorporation 1 year Chairman of the Board of Directors President Number of Directors 12 Appointment of Outside Directors Appointed Number of Outside Directors 5 Number of Independent Directors Designated from among Outside Directors 5 Outside Directors’ Relationship with the Company (1)

Name Attribution Relationship with the Company (※) Hiromichi Yoshitake Other d△ Toru Nagasawa Lawyer h△ Tomomi Nakano Certified public accountant Shoichiro Tozuka From other company h○ Yoshimi Shu From other company ※Relationship with the Company

○ : Outside director herself/himself is currently applicable or was applicable until recently

△ : Outside director herself/himself was applicable in the past

● : Close relative of the outside director is currently applicable or was applicable until recently

▲ : Close relative of the outside director was applicable in the past

a. Executive (a person who executes business; hereinafter, the same) of the Company or its subsidiary

b. Non-executive director or executive of the parent of the Company

c. Executive of a fellow subsidiary of the Company

d. Party whose major client or supplier is the Company or an executive thereof

e. Major client or supplier of the Company or an executive thereof

f. Consultant, accounting professional or legal professional who receives a large amount of monetary consideration or other property from the Company besides compensation as a director

g. Major shareholder of the Company (or an executive of the said major shareholder if the shareholder is a corporation)

h. Executive of a client or supplier of the Company (which does not correspond to any of d., e., or f.) (the director himself/herself only)

i. Executive of a corporation to which outside officers are mutually appointed (the director himself/herself only)

j. Executive of a corporation that receives a donation from the Company (the director himself/herself only)

k. Other

Outside Directors’ Relationship with the Company (2)

Name Audit and Supervisory Committee Member Independent Outside Director Additional information Regarding applicable items Reasons for Appointment Hiromichi Yoshitake ○ ○ Although the University of Tsukuba, where he had previously served as executive director and vice president, and Joyo Bank, a subsidiary bank of the Company, engage in ordinary banking transactions, he retired in March 2009 and more than 10 years have passed since. Accordingly, such relationship would not affect his independence from the Company. Mr. Hiromichi Yoshitake has abundant work experience at a major company with achievements as a senior executive and also has academic expertise and management experience as well as a broad insight through his career at multiple universities. He is selected as Outside Director who is an Audit and Supervisory Committee Member in the expectation that he may fulfill supervisory functions through appropriate guidance and advice on the overall management of the Company utilizing his broad insight, academic expertise, and management experience at universities. He satisfies “Independence Standards for Outside Directors” of the Company, and is registered as an Independent Director who does not have conflict of interest with general shareholders. Toru Nagasawa ○ ○ Although he has had advisory contract with Ashikaga Bank, he cancelled it in April 2016. The past terms & conditions of transactions were determined based on these of other regular transactions and the past 3-years average amount of compensation paid by the Group and other financial profits was less than ¥10 million. Accordingly, such relationship would not affect his independence from the Company. Mr. Toru Nagasawa does not have experience related to business management other than as outside officer, but has specialized knowledge and experience in corporate legal affairs as an attorney, and has conducted his duties appropriately as Outside Director of Ashikaga Holdings Co., Ltd. since June 2016, and Outside Director (Audit and Supervisory Committee Member) of the Company since October 2016. He is elected as Outside Director who is Audit and Supervisory Committee Member in the expectation that he may continue to provide guidance and advice from a specialist’s perspective in relation to the overall business management of the Company. He satisfies “Independence Standards for Outside Directors” of the Company, and is registered as Independent Director who does not have conflict of interest with general shareholders. Tomomi Nakano ○ ○ - Ms. Tomomi Nakano has experience as Outside Officer of listed companies and listed group companies, and has specialized knowledge and experience as a certified public accountant and tax accountant. She is selected as Outside Director who is an Audit and Supervisory Committee Member in the expectation that she may provide appropriate guidance and advice from a specialist’s perspective in relation to the overall business management of the Company. She satisfies “Independence Standards for Outside Directors” of the Company, and is registered as Independent Director who does not have conflict of interest with general shareholders. Shoichiro Tozuka ○ Although SUBARU CORPORATION, where he has served as Senior Vice President to March 2024, and our subsidiary banks, Joyo Bank and Ashikaga Bank, engage in ordinary banking transactions, the percentage of sales gained through the business with SUBARU CORPORATION and the percentage of gross profits gained through the business with SUBARU CORPORATION of consolidated net gross profits of the Group, are less than 2% respectively.

Accordingly, such relationship would not affect his independence from the Company.Mr. Shoichiro Tozuka has abundant work experience at a major company with achievements as a senior manager. He is selected as a candidate for Outside Director in the expectation that he will utilize his experience to fulfill his supervisory function through appropriate guidance and advice on overall management of the Company. He satisfies “Independence Standards for Outside Directors” of the Company, and is registered as Independent Director who does not have conflict of interest with general shareholders. Yoshimi Shu ○ - Ms. Yoshimi Shu has accumulated abundant work experience as well as experience and achievements as a senior manager at a global financial institution. In addition, she has obtained insights and experience in various aspects towards the development of corporate leaders and has conducted her duties appropriately as Outside Director of the Company since June 2019. She is selected as Outside Director in the expectation that she may provide appropriate guidance and advice for overall business operation of the Company from a professional perspective. She satisfies “Independence Standards for Outside Directors” of the Company, and is registered as Independent Director who does not have conflict of interest with general shareholders. The Audit and Supervisory Committee

Composition and attribution

Number of total members Number of full-time members Number of inside directors Number of outside directors Chairman The Audit and Supervisory Committee 5 2 2 3 Inside director Directors or employees assigned to assist the committee Assigned Matters regarding the independence of above mentioned directors or employees from executive directors

The Company shall establish the Audit and Supervisory Committee Office and thereto assign one (1) or more full-time employee in order to assist the committee. The said employees shall conduct for assisting the duties of committee members following their directions solely, and not participate in their execution. Regarding his/her personnel transfer, the consent of the committee shall be required.

Status of cooperation among the Audit and Supervisory Committee, external accounting auditors, and internal audit section

- (1)Cooperation between internal audit section and the Audit and Supervisory Committee Full-time members of the Audit and Supervisory Committee enhance to strengthen the cooperation with internal audit section, Audit Department by exchanging opinions regarding audit system and audit policy (internal audit plan), expressing their views as the Audit and Supervisory Committee especially at the planning phase, and being reported on the results of internal audit.

- (2)Cooperation between internal audit section and external accounting auditors Through three-pillar audit system, Audit Department engages in exchanging opinions with external accounting auditor (Deloitte Touche Tohmatsu LLC) regarding audit policy (internal audit plan) as necessary, for securing the effectiveness of internal audit system.

- (3)Cooperation between the Audit and Supervisory Committee and external accounting auditors The Audit and Supervisory Committee shall receive the audit plan with explanation about significant matters, given by external accounting auditor. And also, the committee shall hold opinion exchange sessions (several times a year with the Audit and Supervisory Committees of subsidiary banks) and be reported on the status of audit regularly. By this, the Audit and Supervisory Committee shall exercise its effective supervisory function through a close cooperation with external accounting auditor.

Voluntary Committees

Voluntary Establishment of Committee (s) Equivalent to Nomination Committee or Compensation Committee Established Committee’s Name, Composition, and Chairman’s Attributes

Committee Equivalent to Nomination Committee

Committee Equivalent to Nomination Committee Committee Equivalent to Compensation Committee Committee’s name Corporate Governance Committee Corporate Governance Committee Number of total members 9 9 Number of full-time members 0 0 Number of inside directors 2 2 Number of outside directors 5 5 Number of outside experts 0 0 Number of others 2 2 Chairman Outside director Outside director Supplementary Explanation

The Company has established the Corporate Governance Committee as an advisory body to the Board of Directors to enhance the effectiveness of corporate governance for sustainable growth and medium to long term enhancement of corporate value of the Group. The Corporate Governance Committee shall deliberate matters such as nomination of director candidates and compensation for directors, and shall report back to the Board of Directors.

(Summery of the Corporate Governance Committee)

1. Objective

The Company shall establish the Corporate Governance Committee (hereafter referred to as “the Committee”) as an advisory body to the Board of Directors to enhance the effectiveness of corporate governance for sustainable growth and medium to long term enhancement of corporate value of the Group. The Committee shall deliberate matters as follows, and shall report back to the Board of Directors.- (1)Election of president and directors candidates, and reappointment or dismissal of directors

- (2)Succession plan and development of directors’ candidates

- (3)Compensation for directors

- (4)Collection and analysis of opinions of shareholders

- (5)Other matters in response to request from the Board of Directors about improvement of corporate governance

2. Composition

- Committee members shall be composed of all outside directors of the Company, the representative director and outside directors nominated by subsidiary banks (one person from each bank).

- The chairman shall be elected by the Committee from among the independent outside directors of the Company.

- The majority of the Committee members shall be outside directors (including outside directors of subsidiary banks).

(※) Current Composition of the Committee Members Out of nine (9) members, independent outside directors are a majority at five (5) (55%).

3. Operation

- The Committee meeting shall be held timely as required.

- The chairman may hold the Committee meeting without the participation of Outside Directors of the subsidiary banks with prior consent of said Outside Directors as required.

- The Board of Directors shall respect the opinions of the Committee which shall be reflected to the decision-making regarding significant matters, and supervision of directors’ duties. Through the deliberation at the Committee meeting, outside directors shall secure the opportunities such as “colleting necessary information and cooperating among outside directors for their supervisory function”, “appropriate determination from an independent and objective standpoint” and “expression of opinions with active execution of authority”.

4. Activities

- In fiscal year 2024, the Committee meeting was held four (5) times and deliberated matters concerning IR activities (dialogue with shareholders) in addition to the election of director candidates and compensation for directors. Attendance of each member at the Committee is as follows.

【committee member】 Name Attendance Chairman Hiromichi Yoshitake (outside director) attended all 5 in-person meetings Toru Nagasawa (outside director) attended all 5 in-person meetings Tomomi Nakano (outside director) attended all 4 in-person meetings after appointment Hiromichi Ono (outside director) attended all 5 in-person meetings Yoshimi Shu (outside director) attended all 5 in-person meetings Naoki Goto (outside director, Joyo Bank) attended 3 out of 5 in-person meetings Yoshikatsu Sugiyama (outside director, Ashikaga Bank) attended all 4 in-person meetings after appointment Tetsuya Akino (President and Director) attended all 5 in-person meetings Kazuyuki Shimizu (Executive Vice President and Director) attended all 5 in-person meetings Independent Officers

Number of Independent Officers 5 Other Matters relating to Independent Officers

The Company has designated all five (5) Outside Officers qualified to be Independent Officers as Independent Officers.

“Independence Standards for Outside Directors” are as follows:Article 1 Outside Directors who are independent from the Company meet the legal requisites for Outside Directors as stipulated in Article 2, Item 15 of the Companies Act and do not fall under any of the following items.

- (1)A major shareholder of the Company (holding directly or indirectly 10% or more of the voting rights of the Company) or Executive Director, Executive, Manager, or other employee thereof (hereinafter, the “Executive Directors, etc.”)

- (2)

A person who has the Company and the Group as a major business partner (to which (a) or (b) below applies, and includes its parent company or its significant subsidiaries) or the Executive Directors, etc., thereof

(a) A person who receives payment from the Group of 2% or more of its total consolidated net sales for the most recent fiscal year

(b) A person for which borrowings from the Group is the highest, and substituting the borrowings by another fund procurement method in the short term is deemed difficult

- (3)

A major business partner of the Group (to which (a) or (b) below applies, and includes its parent company or its significant subsidiaries) or the Executive Directors, etc., thereof

(a) A person who pays to the Group 2% or more of consolidated gross profit of the Company for the most recent fiscal year

(b) A person which is important to the Group in the fund procurement aspect; that is, a major creditor, etc., on which the Group depends to the extent that it is irreplaceable

- (4)Directors or other Executive Directors, etc., of a corporation or organization which has received donations from the Group for an annual average of more than 10 million yen for the past three years

- (5)A consultant, accounting specialist, or legal professional (in the case of corporations or other organizations, a person who belongs to such groups is included) who has received from the Group compensation or other property benefit for an annual average of 10 million yen or more, excluding officer remuneration, for the past three years

- (6)A person who has fallen under any of (1) to (5) above in the past three years

- (7)An individual affiliated with a party with which the Group has a personnel relationship of mutual dispatch of outside officers

- (8)An individual whose spouse or relative within the second degree of kinship falls under (1) to (7) above

- (9)A person which might potentially pose continual and substantial conflict of interest with overall general shareholders of the Company due to reasons not provided in (1) to (8) above

Article 2 Even in the event that a person does not satisfy items (1) through (9) set forth above, the Company may appoint as its outside director a person who it believes to be suitable for the position of an outside director with sufficient independence in consideration of such person’s character and insight, provided that it fulfills the requirements of the Companies Act , and it externally provides an explanation as to why it believes such person qualifies as an outside director with sufficient independence.

Incentives

Implementation of Measures to Provide Incentives to Directors Introduction of Performance-linked Compensation and Others Supplementary Explanation

The Company has introduced performance-linked compensation system regarding the bonuses for executive directors. In addition to basic amount for each position, individual bonuses shall be distributed based on contribution to business performance by each executive director, within the limits of total amount determined in accordance with the consolidated target achievement rate and consolidated ROE (net income÷total shareholders’ equity) for each fiscal year.

For the purpose of promoting further value-sharing with the Company’s shareholders and providing an additional incentive to the Directors, excluding Outside Directors and Directors who are Audit and Supervisory Committee Members, to achieve the sustainable enhancement of the Company's corporate value, we have introduced a restricted stock remuneration plan.

The recipients of the restricted stock remuneration plan are the Directors, excluding Outside Directors and Directors who are Audit and Supervisory Committee Members, and executive officers of the Company and subsidiary banks.Recipients of Stock Options - Supplementary Explanation

-

Compensation for directors

Disclosure of Individual Directors’ Compensation No individual disclosure Supplementary Explanation

The total amount of compensation to directors shall be disclosed in the annual securities reports.

Policy for Determining Compensation Amounts or Calculation Methods Thereof Established Disclosure of Policy for Determining Compensation Amounts or Calculation Methods Thereof

Under the Corporate Governance Policy set by the Board of Directors, the director’s compensation amount shall be determined separately for “directors (excluding Audit and Supervisory Committee Members)” and “directors (who are Audit and Supervisory Committee Members)” as follows.

【Directors (excluding Audit and Supervisory Committee Members)】

- The compensation for directors (excluding Audit and Supervisory Committee Members) shall be determined appropriately in consideration to their transparency, fairness, objectivity and incentives toward improving results by enhancing the linkage of compensation with the Group’s performance and shareholders’ benefits.

- The amount for each director (excluding Audit and Supervisory Committee Members) shall be determined by the Board of Directors within the maximum amount of compensation per year resolved at the General Meeting of the Shareholders, while ensuring the objectivity and transparency after deliberation regarding their adequacy and validity in the Corporate Governance Committee.

【Directors (who are Audit and Supervisory Committee Members)】

- The compensation for directors (who are Audit and Supervisory Committee Members) shall be determined without the factor of incentive to ensure the transparency of their duties as auditor and supervisor.

- The amount for each director (the Audit and Supervisory Committee Member) shall be determined through discussion among all Audit Committee Members and within the maximum amount of compensation per year resolved at the General Meeting of the Shareholders.

The Company resolved the maximum amount of compensation for directors (excluding Audit and Supervisory Committee Members) at &#yen;200 million per year (the number of eligible directors: 7 persons) and for Audit and Supervisory Committee Members at &#yen;80 million per year (the number of eligible directors: 5 persons), at the Ordinary General Meeting of the Shareholders held on June 28, 2016.

Details of compensation system are as follow.

【Executive Directors among the Directors (excluding Audit and Supervisory Committee Members)】

- (a)Composition of compensation

- The compensation comprises a monthly compensation as a basic compensation, bonuses as a performance-linked compensation and a restricted stock remuneration plan as a non-monetary compensation.

- Composition ratio of each type of compensation (%)

<For the Company alone>

monthly compensation: bonuses: restricted stock compensation plan = 86 : 7 : 7

<When combined with the amounts paid by the subsidiary banks (Joyo Bank and Ashikaga Bank) for the directors who serve concurrently>

monthly compensation: bonuses: restricted stock compensation plan = 70 :18 :12 (approximately)

(Both cases are in which the standard amount of bonuses is paid) - Furthermore, in order to enhance value sharing with our shareholders and to increase the motivation to contribute to corporate value enhancement, we have decided to revise the directors’ compensation system effective June 24, 2025. This decision was made at the Board of Directors meeting of the Company held on May 12, 2025, and at the Board of Directors meeting of the subsidiary banks held on May 9, 2025. After the revision, the ratio of restricted stock compensation to total compensation will be increased, resulting in the following composition (based on standard bonus amounts).

①The Company alone

<For President, Director / Executive Vice President, Director>

monthly compensation : bonuses : restricted stock compensation = 66 : 6 : 28

<For Director>

monthly compensation : bonuses : restricted stock compensation = 86 : 7 : 7②When combined with the amounts paid by the subsidiary banks

<For all positions>

monthly compensation : bonuses : restricted stock compensation = 60 :15: 25 (approximately)

- (b)Contents of each compensation, etc.

- Monthly compensation

The amount of monthly compensation as a basic compensation shall be determined by the director’s position. - Bonuses

The basic amount of bonuses shall be determined in accordance with the director’s position and the total amount of bonus payment shall be determined within a maximum amount which fluctuates each year in the range of 0% to 150% according to the Company’s consolidated target achievement rate and consolidated ROE (net income÷total shareholders’ equity). The amount for each executive director shall be determined based on the basic amount for the director’s position, which is adjusted according to the degree of contribution to business performance by each executive director.

The percentage of the total bonuses is composed of 80% linked to the Company's consolidated target achievement rate and 20% linked to consolidated ROE, each of which increases or decreases in the range of 0% to 150%, depending on the fiscal year's performance.

The Indicator based on the Company’s consolidated target achievement rate has been adopted in order to give stronger incentives to achieve an annual business plan. In the current fiscal year 2024, the targets were set at ¥75.1 billion of ordinary profit and ¥52.1 billion of net income, and the achievement rates of each indicator, weighted by the ratio of ordinary profit : net income = 70% : 30%, was 110.7%.

The indicator based on ROE (net income÷total shareholders’ equity) has been adopted in order to give stronger incentives to the directors to improve the Group’s corporate value. Under the Third Medium-Term Group Business Plan (period: April 1, 2022 to March 31, 2025), a ROE of 5.5% or more was targeted, and in the current fiscal year 2024, the ROE of 6.6% was achieved.

In addition, in accordance with the revision of the directors’ compensation system described in (a), the following revisions will be made to bonuses, which will take effect from bonuses related to the fiscal year ending March 2026.①Review of the definition of consolidated ROE

To align with the consolidated ROE target set in the Fourth Medium-Term Group Business Plan (April 1, 2025, to March 31, 2028), the denominator for calculation will be changed from shareholders' equity to net assets (calculated as net income ÷ net assets).②Review of the variability range

To enhance incentives for improving consolidated ROE, the variability range for the portion linked to consolidated ROE will be expanded to “0% to 200%.” The variability range for the portion linked to the achievement rate of consolidated targets will remain unchanged at “0% to 150%.” - Restricted Stock Remuneration Plan

Under the Plan, the Company’s Directors (excluding Directors who are Audit and Supervisory Committee members ; the “Eligible Directors”) shall make payments in kind as contributed assets using all of the monetary compensation claims provided to them by the Company and receive the issuance or disposal of the Company’s common shares and the Company and each of the Eligible Directors shall enter into a restricted stock allocation agreement.

The remuneration to be paid to the Eligible Directors for the granting of restricted stock shall be monetary compensation claims and the total amount of such claims is set at 20 million yen or less per year within the amount of remuneration for the Company’s Directors (excluding Directors who are Audit and Supervisory Committee Members), and the total number of common shares newly issued by the Company is set at 200 thousand shares or less per year, as resolved at the Ordinary General Meeting of the Shareholders held on June 24, 2020. The allocation of payment to each Eligible Director shall be determined by the director’s position.

- Monthly compensation

<Details of restricted stock allocation agreement (the “Allocation Agreement”)>

- (1)Transfer Restriction Period

The Eligible Directors may not transfer, use as collateral or otherwise dispose of the Company’s common shares allocated in accordance with the Allocation Agreement (the “Allotted Shares”) for a period of 30 years (the “Transfer Restriction Period”) from the date on which allocation was received in accordance with the Allocation Agreement (this prohibition is hereinafter referred to as the “Transfer Restriction”). - (2)Treatment in the event of resignation

In the event that an Eligible Director, prior to the expiry of the Transfer Restriction Period, resigns from a position stipulated by the Company’s Board of Directors for any reason other than the expiry of the term of office, death or any other legitimate reason, the Company shall rightfully acquire the Allotted Shares without consideration. - (3)Removal of Transfer Restrictions

Notwithstanding the provisions of (1) above, the Company shall remove the Transfer Restrictions on all Allotted Shares, at the expiry of the Transfer Restriction Period, on the conditions that the Eligible Director continuously remains in a position stipulated by the Company’s Board of Directors during the Transfer Restriction Period. However, if the Eligible Director resigns from a position stipulated by the Company’s Board of Directors prior to the expiry of the Transfer Restriction Period due to the expiry of the term of office, death or any other legitimate reason, stipulated in (2) above, the number of the Allotted Shares for which the Transfer Restrictions are to be removed and the timing of the removal of the Transfer Restrictions shall be reasonably adjusted, as necessary. Furthermore, the Company shall rightfully acquire without consideration any Allotted Shares for which the Transfer Restriction had not been removed immediately after the removal of the Transfer Restrictions in accordance with the above provisions. - (4)Handling in the case of organizational restructuring, etc.

Notwithstanding the provisions in (1) above, during the Transfer Restriction Period, in the case that a merger agreement in which the Company becomes the non-surviving company, a share exchange agreement or share transfer plan in which the Company becomes a wholly-owned subsidiary or other matters related to its organizational restructuring is approved at the general meeting of shareholders of the Company (or at the Board of Directors, if such organizational restructuring in question does not involve the approval of the general meeting of shareholders of the Company), the Company shall remove the Transfer Restriction on all Allotted Shares, by resolution of the Board of Directors of the Company, prior to the effective date of such organizational restructuring, etc. Furthermore, the Company shall rightfully acquire without consideration any Allotted Shares for which the Transfer Restriction had not been removed immediately after the removal of the Transfer Restrictions in accordance with the above provisions. - (5)Other matters

Other matters relating to the Allocation Agreement shall be determined by the Board of Directors of the Company.

【Outside Directors among the Directors (excluding Audit and Supervisory Committee Members)】

- (a)Composition of compensation

- The compensation for outside directors (excluding Audit and Supervisory Committee Members) is comprised only of a monthly compensation

- (b)Contents of each compensation, etc.

- The amount of monthly compensation as a basic compensation shall be fixed by the director’s position.

【Directors (who are Audit and Supervisory Committee Members)】

- (a)Composition of compensation

- The compensation for directors who are Audit and Supervisory Committee Members is comprised only of a monthly compensation

- (b)Contents of each compensation, etc.

- The amount of monthly compensation shall be determined separately for full time and part time directors.

After deliberation of the Corporate Governance Committee, which was established as an advisory body to the Board of Directors to ensure its objectivity and transparency, individual compensation for “directors (excluding Audit and Supervisory Committee Members)” shall be decided by the Board of Directors, and that for “directors (who are Audit and Supervisory Committee Members)” shall be decided by the Audit and Supervisory Committee.

The majority of the Corporate Governance Committee Members shall be outside directors (including outside directors nominated by wholly-owned banks), and the chairman shall be elected from among outside directors.

In fiscal year 2024, activities in decision process for directors’ compensation by the Corporate Governance Committee and the Board of Directors are as follows.(The Corporate Governance Committee)

date contents April 26, 2024 Matter regarding total amount of directors’ bonuses, and the amount of compensation for each director (excluding Audit and Supervisory Committee Members) (The Board of Directors)

date contents May 10, 2024 Matters regarding directors’ bonuses, and planned disposal of treasury shares as restricted stock compensation June 26, 2024 Matters regarding determining monthly compensation amount, and provision of monetary compensation claims and disposal of treasury shares for the restricted stock compensation Regarding determining the details of compensation for each director, the Corporate Governance Committee shall deliberate including the confirmation of the integrity with the above policy and the related regulations. Therefore, the Board of Directors shall in general respect their proposals and judge them to be in line with policy.

The decision of the specific amount for each director is delegated to the President (the Representative Director) by resolution of the Board of Directors. This authority is the decision regarding specific amount of bonuses distributed to each director. The reason for the delegation is that they are in a position to judge the degree of contribution to the performance by each director from a company-wide perspective. Regarding this decision, the Corporate Governance Committee shall deliberate including the confirmation of the integrity with the above policy and the validity. Therefore, the Board of Directors shall in general respect their proposal and judge it to be in line with policy.

Supporting System for Outside Directors

The Board of Directors shall take measures for the materials made to the outside directors about the matters referred to meeting of the Board of Directors, and explanations of agenda previously. In addition, the Company shall assign full-time employee in order to assist the Audit and Supervisory Committee as required for the supervisory duties.

Status of Persons Retired from Representative Director and President

Names of Advisors (“sodanyaku,” “komon,”etc.) who have formerly served as Representative Director and President, etc.

Name Ritsuo Sasajima Title/Position Director, Chairman of The Joyo Bank, Ltd. Responsibilities Supervision of The Joyo Bank, Ltd. Working Arrangement/Conditions

(Full-time or Part-time, Compensation, etc.)Full-time, Paid Date of Retirement from President, etc. June 24, 2022 Term To the closing of the Ordinary General Meeting of Shareholders as of March 31, 2026 (FY2025) Name Masanao Matsushita Title/Position Director, Chairman of The Ashikaga Bank, Ltd. Responsibilities Supervision of The Ashikaga Bank, Ltd. Working Arrangement/Conditions

(Full-time or Part-time, Compensation, etc.)Full-time, Paid Date of Retirement from President, etc. June 24, 2020 Term To the closing of the Ordinary General Meeting of Shareholders as of March 31, 2026 (FY2025) Name Kazuyoshi Terakado Title/Position Special Advisor of The Joyo Bank, Ltd. Responsibilities Activities in public office and regional contribution activities (No involvement in management). Working Arrangement/Conditions

(Full-time or Part-time, Compensation, etc.)Part-time, Paid Date of Retirement from President, etc. June 25, 2019 Term To the end of June 2026 Number of advisors (“sodanyaku,” “komon,”etc.) who have formerly served as Representative Director and President, etc. 3 Other Matters

- The Company does not have a system of advisors (“sodanyaku,” “komon,”etc.).

- Mr. Masanao Matsushita has served as President and Chief Executive Officer of the Company (formerly, Ashikaga Holdings Co., Ltd.) until October 1, 2016. At the same time when the Company integrated with Joyo Bank, he took office as Executive Vice President and Director of the Company.

2. Matters regarding the Function of Execution of Duties, Audit and Supervision, Appointment, Decisions on Compensation, etc. (Overview of Current Corporate Governance system)

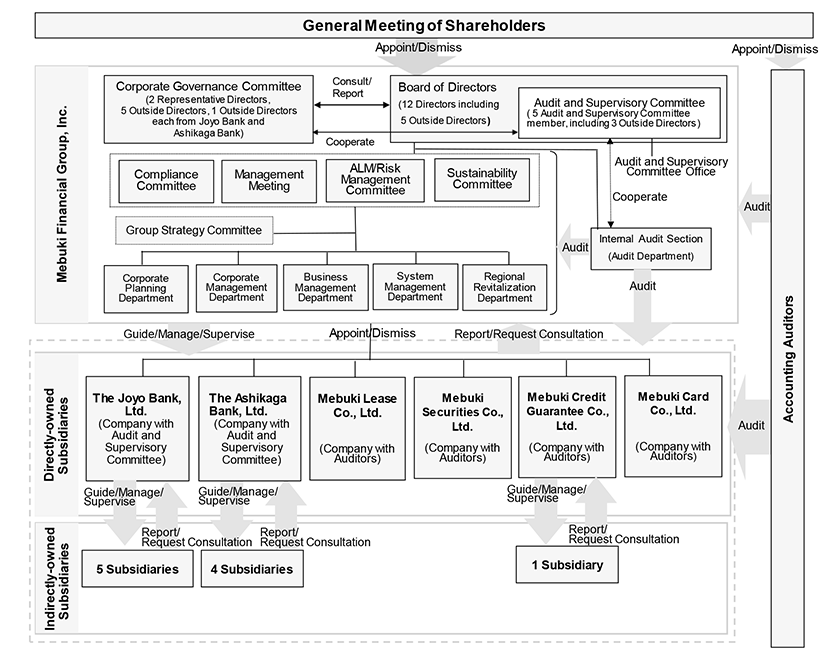

- (1)Our current corporate governance system is as follows.

(a) Board of Directors

The Board of Directors consists of twelve (12) directors (of which five (5) are outside directors). It decides basic corporate policies and important business matters and supervises the execution of duties by directors. We aim to realize prompt and decisive decision-making and business execution by entrusting most decision-making authorities relevant to business execution to directors as constituent members of the Board of Directors in which our Group’s knowledge and expertise are concentrated, while ensuring the transparent and fair decision-making function and the solid supervisory function through the appointment of multiple outside directors such as persons with experience of corporate management, lawyers and academic experts. The Board of Directors meets once a month in principle. In fiscal year 2024, the Board of Directors was held twelve (12) times and attendance of each director is as follows.【Directors (excluding Audit and Supervisory Committee Members)】 Attendance Tetsuya Akino attended all 12 meetings Kazuyuki Shimizu attended all 12 meetings Yoshitsugu Toba attended all 10 meetings after appointment Yoshihiro Naito attended all 12 meetings Toshihiko Ono attended all 12 meetings Hiromichi Ono attended all 12 meetings Shu Akemi attended all 12 meetings 【Directors (Audit and Supervisory Committee Members)】 Attendance Hitoshi Takenouchi attended all 10 meetings after appointment Yoshinori Tasaki attended all 12 meetings Hiromichi Yoshitake (outside director) attended all 12 meetings Toru Nagasawa (outside director) attended all 12 meetings Tomomi Nakano (outside director) attended all 10 meetings after appointment (b) Audit and Supervisory Committee

The Audit and Supervisory Committee, which consists of five (5) directors (of which three (3) are outside directors) who are Audit and Supervisory Committee Members, audits the execution of duties by directors and determines the details of proposals related to the appointment, dismissal, and non-reappointment of the accounting auditors to be submitted to the General Meeting of Shareholders. The Audit and Supervisory Committee meets once a month in principle.(c) Corporate Governance Committee

We have established the Corporate Governance Committee as an advisory body to the Board of Directors to enhance the effectiveness of corporate governance for sustainable growth and the medium to long term enhancement of corporate value of the Group. The Corporate Governance Committee, composed by a majority of outside directors (including outside directors of wholly-owned banks), deliberates matters regarding nomination of director candidates and compensation for directors, and reports back to the Board of Directors.(d) Decision-making bodies

We have established the Management Meeting, the ALM/Risk Management Committee, the Compliance Committee and the Sustainability Committee as the bodies to discuss and decide important matters regarding business execution based on the decisions made bay the Board of Directors.- Management Meeting

The Management Meeting, which consists of all executive directors and all executive officers, is responsible for making decisions on business execution to the extent of the authorities delegated by the Board of Directors, as well as discussion on important matters regarding business execution. The Management Meeting is held once a month and additionally as necessary. - ALM/Risk Management Committee

The ALM/Risk Management Committee, which consists of all executive directors and all executive officers, the general manager of Corporate Planning Department, the general manager of Corporate Management Department and the general manager of the Basel Unit of Corporate Management Department, is responsible for making decisions on business execution relevant to group risk management and ALM to the extent of the authorities delegated by the Board of Directors and for considering and discussing important matters on business execution. The ALM/Risk Management Committee meets once a month and additionally as necessary. - Compliance Committee

The Compliance Committee, consisting of all executive directors and all executive officers, the general manager of Corporate Planning Department, the general manager of the Corporate Management Department and the general manager of Audit Department, is responsible for making decisions on business execution regarding compliance to the extent of the authorities delegated by the Board of Directors, and considering and discussing important matters relevant to practice of compliance. The Compliance Committee holds a meeting quarterly and additionally as necessary. - Sustainability Committee

The Sustainability Committee, consisting of all executive directors and all executive officers, the general manager of Corporate Planning Department, the general manager of the Corporate Management Department and the general manager of Regional Revitalization Department, is responsible for making decisions on business execution regarding promotion of sustainability to the extent of the authorities delegated by the Board of Directors, and considering and discussing important matters relevant to promote sustainability. The Sustainability Committee holds a meeting semi-annually and additionally as necessary.

- (2)For ensuring the effectiveness of audits performed by the Audit and Supervisory Committee, the internal audit section (Audit Department) shall, in collaboration with the Committee, ensure development of internal auditing system and human resources. Audit Department consists of 33 persons (as of the end of May 2025). For the appropriate and effective execution of the duties by the Committee, the Company shall establish an Audit and Supervisory Committee Office and assign full-time employee in order to secure an appropriate auditing environment for the Committee.

The Audit and Supervisory Committee Members shall have knowledge and experience to be suitable as a supervisor. Furthermore, the majority of the members (3 persons) are outside directors with sufficient independence and we shall elect the members with appropriate knowledge in finance, accounting and legal. - (3)The Company stipulates in the Articles of Incorporation concerning a contract of limited liability agreement with outside directors. Based on the Articles of Incorporation, the Company has entered into the agreement with all outside directors, and the summary is as follows.

(Limited Liability Agreement)

If the outside director has performed his/her duties in good faith and without gross negligence, the liability of the outside director to the Company under Article 423-1 of the Companies Act shall be limited to 10 million yen or the amount provided in Article 425-1 of the Companies Act, whichever is higher.3. Reasons for Adoption of Current Corporate Governance System

In terms of institutional design, the Company takes the form of a company with an audit and supervisory committee, and thereby seeks to realize prompt and decisive decision-making and business execution by entrusting many of the decision-making authorities relevant to business execution to directors as constituent members of the Board of Directors in which the knowledge and expertise of the Group are concentrated, while ensuring a transparent and fair decision-making function and a solid audit and supervisory function through the appointment of multiple outside directors.

Ⅲ Implementation of Measures for Shareholders and Other Stakeholders

1. Measures for Activation of General Meeting of Shareholders and Smooth Exercise of Voting Rights

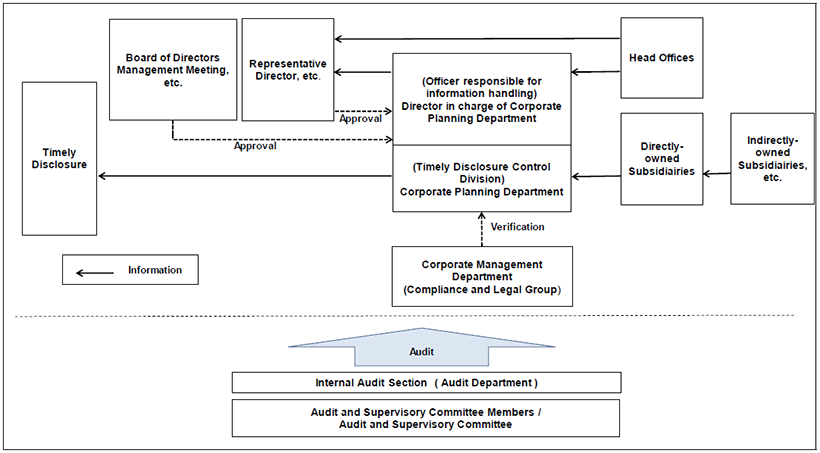

Supplementary Explanation Early Notification of General Meeting of Shareholders On June 2, 2025, we sent the convocation notice of the 9th ordinary general meeting of shareholders 22 days prior to the date of the meeting held on June 24, 2025. Scheduling the Date of the General Meeting of Shareholders Avoiding Peak Days The Company sets the date of the meeting avoiding the peak day through a year. Voting Using Electronic Voting Facilities The Company facilitates the exercise of voting rights via the Internet for enhancing the convenience for shareholders who are unable to attend the meeting. Utilization of Electronic Voting Platform and other methods of improving the environment for institutional investors The Company uses the electronic voting rights exercise platform for institutional investors operated by ICJ, Inc. Providing Convocation Notice in English (Translated Partially) The Company created an English version of the convocation notice (partial translation), of the 9th ordinary general meeting of shareholders held on June 24, 2025, after that, disclosed it to the Tokyo Stock Exchange and posted it on the electronic voting platform for institutional investors operated by ICJ, Inc. and our website. Others The Company disclosed the convocation notice of the General Meeting of Shareholders to the Tokyo Stock Exchange on May 29, prior to the sending date, and also posted it on our website. After the conclusion of the meeting, the business report and the results of the exercise of voting rights are posted on our website. 2. IR Activities

Supplementary Explanation Explanation by Representative Establishing and Announcing “Disclosure Policy” The Company considers proactive disclosure as part of corporate governance. And the creditworthiness from shareholders and investors enhanced by sufficient disclosure shall lead to increase shareholder value. We have established "Disclosure Policy" which defines basic approach and policy of the Group regarding information disclosure. And it is available on our website. Regular IR meetings for Individual Investors The Company uploaded the video of our IR meeting on our website. No Regular IR meetings for Analysts and Institutional Investors The Company planned to hold IR meetings for analysts and institutional investors 2 times per year, after the financial results announcement. Yes Posting of IR Materials on Website IR Presentation Materials for analysts and institutional investors shall be promptly posted on our website. In addition, the Company shall post English version at the same time. Establishment of Department and/or Manager in Charge of IR The Company has established Public Relations Office in Corporate Planning Department.

A director in charge of IR has been assigned to Corporate Planning Department.3. Measures for Respecting Stakeholders

Internal Regulations to Respect Stakeholders

Under the Group philosophy of “providing high-quality comprehensive financial services to continue building a more prosperous future by together with local communities”, the Group will create appropriate collaboration with all stakeholders, including shareholders, customers, employees and local communities, and will contribute to sustainable growth of local communities.

Implementation of Environmental Activities, CSR Activities

<Initiatives for Sustainability>

Recognizing issues about sustainability as important management agendas, the Group has formulated the “Group Sustainability Policy” with the aim of achieving both the sustainable growth and the corporate value enhancement of the Group, while solving the issues of and realizing the sustainable growth of local communities. In addition, based on changes in social and economic trends and environmental awareness, the Group has defined 1) Support the growth of local industries, 2) Contribute to a safe and prosperous lifestyle, 3) Contribute to decarbonized society and environmental conservation, 4) Provide high-quality services to be chosen by customers consistently, and 5) Strengthen management base for value creation as key issues (materiality) which will particularly focus on contributing to the realization of sustainable local communities, while solving the issues of local communities.

Furthermore, we have formulated independent policies to clarify policies regarding Environment, Human Rights, and Diversity, and we conduct business operations in accordance with each policy.

The Company has disclosed the details of specific initiatives and information disclosure in line with the recommendation of TCFD (The Task Force on Climate-related Financial Disclosures) on the “Initiatives for Sustainability” and the relevant pages of the “Integrated Report (Annual Report)” and “Approach to Sustainability and its Initiatives” of the “Securities Report” which are available on our website.

“Initiatives for Sustainability”:(https://www.mebuki-fg.co.jp/eng/esg/esg.html)

“Integrated Report (Annual Report)”:(https://www.mebuki-fg.co.jp/eng/shareholder/ir_library/annual_report/)

“Securities Report”:(https://www.mebuki-fg.co.jp/eng/shareholder/ir_library/securities/)<Investment in Human Capital and Intellectual Capital>

We have defined our vision in the “Long-Term Vision 2030” as“A Value Creation Group Working Together with Local Communities”. We will reinforce our core businesses of traditional banking services (Improvement Area) and comprehensive financial services (Growth Enhancement Area) and work to expand business areas that leverage these strengths. We will work to resolve local issues beyond the conventional framework of financial services and reinvest know-how obtained through these efforts into our core business to create new value.

In order to realize this goal, “Human Resources” are an important factor in the evolution of the Group's business and the execution of these business strategies. Therefore, through increasing the engagement of each employee, developing and securing human resources capable of creating value, and enhancing job satisfaction, we will form a diverse and self-reliant group that can provide local communities and customers with new value and a peace of mind.

The Company has disclosed the details of specific initiatives on the “Initiatives for Sustainability” and the relevant pages of the “Integrated Report (Annual Report)” and “Approach to Sustainability and its Initiatives” of the “Securities Report” which are available on our website.

“Initiatives for Sustainability”:(https://www.mebuki-fg.co.jp/eng/esg/esg.html)

“Integrated Report (Annual Report)”:(https://www.mebuki-fg.co.jp/eng/shareholder/ir_library/annual_report/)