Changes in the social situation, called “the 100-year life,” have diversified customers’ worries and concerns. We have proactively worked to expand our financial services leveraging our knowledge of gerontology and have also provided meticulous support to help solve problems and cater to diverse needs in financial transactions of customers. These activities are aimed at ultimately creating local communities in which people can continue to live their lives in comfort.

Enhance Our Response to an Aging Society

Enhance our system to provide various services related to gerontology

We will strengthen our connections with customers by developing systems, such as enriching specialized staff and setting up a consulting salon, so that elderly customers and their families can feel comfortable talking about their concerns. We will also work to enhance comfort and safety of customers in collaboration with communities and external institutions, including watching over the elderly in collaboration with local governments and a security company and preventing damages from fraudulent phone calls in collaboration with the police.

One-stop services responding to problems of the elderly and their families

We will work to provide one-stop solutions at our banks to solve problems of elderly customers and their families, including not only financial services such as asset management and succession but also non-financial services such as support for living environment and housekeeping services in collaboration with players in other industries. We will provide consulting on any concerns at our bank counters to increase revenues directly derived from our core business such as those related to customer assets under custody and asset succession, and take on challenges to non-financial service areas such as solving customers’ concerns about their housing and daily life issues, thereby expanding our business areas and improving our corporate value.

Enhance Our System to Provide Various Services related to Gerontology

Strengthen connections with elderly families

To ease the anxiety of the elderly themselves and their families about the present and the future even a little, we have put in place a structure to provide comprehensive support for their financial and non-financial concerns by placing specialized staff at branches and setting up a specialized consulting salon to develop a system that allows customers to take their time to thoroughly consult with our bank staff.

<Smileful Partner>

We have enhanced the placement of specialized staff who responds to concerns of elderly customers and their families (Smileful Partner).

- Respond to current and future concerns

- Address a decline in cognitive function

- Support smooth asset succession to the next generation

- Cultivate measures to prevent financial crimes, etc.

<Holiday Wealth Salon>

An appointment-only salon providing inheritance consulting services that are available only on Saturdays and Sundays in which specialized staff supports customers in an easy-to-understand and careful manner.

The salon provides not only individual customers but also couples, and families living separately from the customers with opportunities to take time out to discuss families’ assets.

Strengthening collaboration with external institutions

In addition to developing in-house bank systems, we have put in place a more comprehensive support system that allows the elderly to be watched over by the entire community by collaborating with a security company and other external partners and with each municipality.

- Provision of a watching service for the elderly in collaboration with a security company

- Implementation of measures to prevent damages from fraudulent phone calls in collaboration with the police

- Placement of care-fitters at branches

- Acquisition of qualifications as dementia supporter by executives and employees, etc.

▶Dementia supporters: Approx. 9,300 people (As of March 31, 2023) - Collaboration with each municipality and regional comprehensive support center

▶Watching over the elderly and other customers

We have strengthened our collaboration with relevant institutions and watched over those who are in need of support so that the elderly can live in their communities in comfort.

Services offered when inheritance occurs

<Remote reception of inheritance proceedings>

In the event of death of a customer, Joyo Bank and Ashikaga Bank offer services not only at a branch counter but also through multiple channels, such as online, telephone, and mail, available at customers’ preference to improve their convenience. Specialized staff in the head offices offer meticulous services through online consultation.

<Using a common inheritance notification form>

Joyo Bank and Ashikaga Bank have decided to use a common inheritance notification form required to be submitted by customers as part of the procedures for inheritance of deposits, etc. with other financial institutions in Ibaraki Prefecture (Tsukuba Bank, Mito Shinkin Bank, The Yuki Shinkin Bank, The Ibaraki-ken Credit Cooperative).

One-Stop Services Responding to Problems of the Elderly and Their Families

Enhancing services/products for the elderly

Asset management

To be prepared for the worst, the Group provides support for customers to make an arrangement to allow their families to manage the customers’ assets on behalf of them or to entrust their asset management to an expert while they are still in good health.

Family contact registration system

When we cannot get in touch with a customer, we will contact the pre-registered family member.

Family trust

In case of impairment in judgment, etc., customers can entrust their asset management to a trusted family member.

Agent card, agent notification

In case of difficulty in visiting a branch due to hospitalization or any other reason, customers can designate an agent to entrust with certain transactions.

Voluntary guardian services

In case of impairment in judgement, etc., customers can entrust their asset management to an expert.

Support for living environment

To meet the needs of customers who want to make use of their house and other real estate properties, we handle loans and other products that can be used for rebuilding and renovation of their houses while keeping cash on hand.

Life support

To provide support for customers to enjoy their daily lives and for their secure life, we provide referral to our partner service providers with whom customers can consult in comfort.

Our banks relieve customers from the trouble and anxiety of finding life support services by themselves by providing referral to the providers of a watching service in collaboration with a security company, a housekeeping service, a renovation service provider, and care facilities.

Asset succession

To ensure smooth succession of customers’ assets, staff with specialized expertise of Joyo Bank and Ashikaga Bank analyze the issues to be addressed and provide advice on the solutions. In collaboration with partner service providers, we also offer services including testamentary trust services that provide comprehensive support ranging from consulting on testamentary preparation to testamentary storage and execution as well as testamentary substitute trust services that allows families of customers to receive money speedily. The services we offer also include Digital Ending Note for succeeding financial, insurance and medical information of the parent generation to their family and the child generation via smartphone.

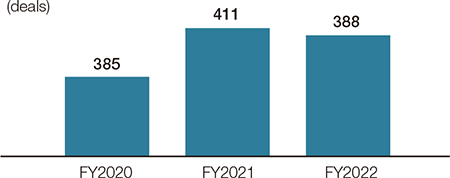

Closed testamentary trust deals (Bank total)

Initiatives for Maintaining and Enhancing Regional Medical and Nursing Care and Welfare

As the aging population grows, regional medical and nursing care and welfare have become increasingly important.

The Group provides various supports for the enhancement of nursing and medical care delivery systems as well as the promotion of activities of the healthy and longer-living elderly so that the elderly in the community and their families can live their lives in comfort.

Through the supports we offer from both financial and non-financial perspectives, we aim to enhance systems related to medical care, welfare, and nursing care, thereby improving the health and quality of life of people in the community, enhancing regional medical care, and creating a sustainable society.

Setting up dedicated teams for medical care

Joyo Bank and Ashikaga Bank have established dedicated teams for medical care to provide attentive consulting to business owners to solve their issues in the fields of medical and nursing care and welfare in collaboration between branches and the head offices as well as with the Group and external institutions.

Through dialogue with business owners, we provide comprehensive support for various management issues, including not only equipment funds and other cash flow management but also securing of human resources, business succession, and ICT utilization in the health and medical fields.

~Example of support menu~

<Information provision>

Medical and nursing care-related seminars held four times (Bank total in FY2023)

Support for management and business succession

- Startup support

- Support for building a business succession scheme

- Support for formulating a hospital reconstruction plan

- Support for market analysis for hospital relocation

- Support for entering into the nursing care business

<Financial support>

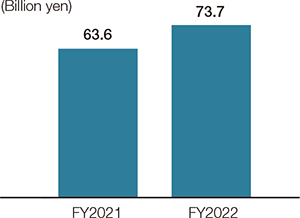

Loans in the medical and welfare fields (Bank total)

Support for medical institutions

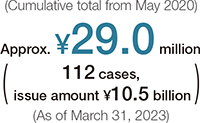

We provided financial support to medical institutions fighting against COVID-19 on the front line through “bond aimed at supporting medical institutions” from May 2020 to March 2023. We donated part of issue commission paid by customers as operating expenses.

We have continued the support by handling the bond as a normal private placement bond with donation scheme since April 2023.

Donation amount of the bond aimed at supporting medical institutions

Initiatives for securing doctors

In collaboration with the Ibaraki Prefectural Government, we provide an educational loan that meets the requirements of the government’s interest subsidy program to support students who want to become doctors. The loan has an interest rate lower than normal and a maximum grace period of six years. The government’s interest subsidy program is intended to reduce the financial burden borne by students who want to be doctors and their families by making the interest rate practically zero, thereby supporting the development of human resources who will be engaged in regional medical care in the future.

Caring for the Elderly

Aiming to become banks providing secure and friendly services to many customers, including the elderly, the Group is continuing to work on the enhancement of facilities, such as barrier-free access of all branches, as well as the enrichment of services and the training of employees.

Aiming for easy-to-access branches

Initiatives for facilitating barrier-free access

With the aim of achieving barrier-free access at all branches, we are working to install and ready with various tools including slopes, parking spaces dedicated for wheelchair access, wheelchairs, as well as hearing aids, writing boards, reading glasses, “comuoon” speaker for the hearing impaired.

We also provide the Inquiry Desk Service Dedicated for Hearing- and Speech-Impaired Customers that accepts inquiries from hearing- and speech-impaired customers via email and fax and the Sign Language Interpreter Relay Service that receives notifications of the loss or theft of a passbook, seal or cash card.

Training of employees

We provide customer service training for customer service (CS) staff at each branch with a lecturer invited from the steering body of “Care-Fitter” so that they can serve elderly and disabled customers attentively and appropriately. We are also developing Dementia Supporters who can serve customers with dementia and their families with the correct knowledge and understanding. We provide training to CS staff and all entry-level bank staff. So far, approximately 7,700 bank staff of Joyo Bank and approximately 1,500 bank staff of Ashikaga Bank have been certified as “Dementia Supporters,” respectively.

Initiatives for protecting financial assets of the elderly

There is no end to fraud cases scamming the elderly out of their assets and cash cards with smooth talk. We as financial institutions strive to prevent frauds in cooperation with the police from the standpoint of protecting customers’ assets.

For instance, we call out to customers at bank counters and ATMs and ask for the details of bank transfers. In addition, we set a limit on the maximum amount to be paid into or drawn out of a bank account using a cash card at an ATM for customers of a certain age and above. While apologizing for any inconvenience this may have caused customers, we ask for their cooperation and understanding by explaining the reasons in detail.

Response to digital divide

Smartphones and web services have become an inseparable part of our daily lives. However, many of the elderly customers are not used to using smartphones. Against this backdrop, we offer the Mini Lesson on Smartphone Utilization (how-to video service) available for customers to watch at our bank counters while getting their business done. The videos are 15 to 20 minutes long and contain useful information ranging from the basic operation of smartphones like tapping and swiping to tips on how to deal with suspicious emails.

- Corporate Information

- IR & SR

- ESG

- Financial Statements & Annual Reports