- home

- ESG Information Index

- Revitalization of the Regional Economy and Local Communities

We are facing major trends such as a declining birthrate and aging population, changes in industrial and employment structures due to digitalization, and the transition to a decarbonized and recycling-oriented society. Furthermore, the prolonged COVID-19 crisis and the emergence of geopolitical risks have also intensified uncertainties. As a result, local customers are forced more than ever before to respond to the diversifying and mounting management challenges they have faced.

The Group will contribute to the realization of sustainable local communities by enhancing consulting services and expanding the Group’s functions to improve the quality of services related to solving problems for local communities and customers and by taking advantage of the Group’s strengths to develop into new business areas.

Responding to management challenges

Enhance the menu of support for business companies

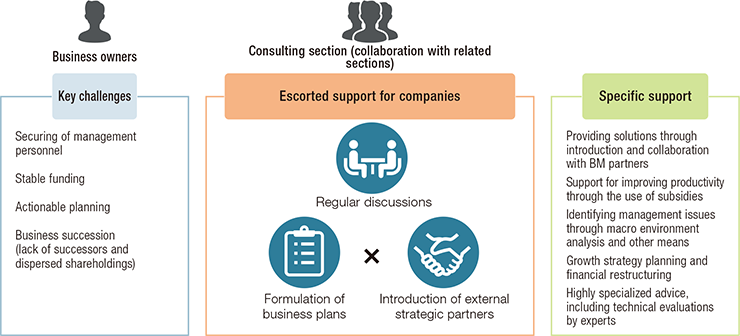

Deepening Consulting Function for Business Companies

We are developing consulting business at all stages of our corporate customers. Our branches and consulting section work together to respond to customer issues and needs by providing highly specialized information and making proposals in cooperation with the Group’s functions, business matching contractors, external experts, and public institutions.

Escorted support for sustainable growth of regional companies

Escorted support for companies

Promoting Industries by Deepening Consulting Function for Business Companies

Supporting our corporate customers in SDGs initiatives

【SDGs declaration support service (Supporting the preparation of written SDGs declarations)】

People’s sense of participation in SDGs initiatives has been growing worldwide. Japanese companies are also expected to contribute to the realization of a sustainable society through environmentally and socially friendly businesses. Promoting SDGs initiatives helps enhance corporate value and create business opportunities. We therefore work to support our corporate customers in SDGs initiatives.

At the Group, we support our corporate customers in participating in SDGs initiatives by giving feedback about the status of them being implemented by our corporate customers and assisting them in preparing written SDGs declarations.

※Joyo Bank and Ashikaga Bank post their corporate customers’ written SDGs declarations on their respective dedicated web pages to support the customers in their PR activities.

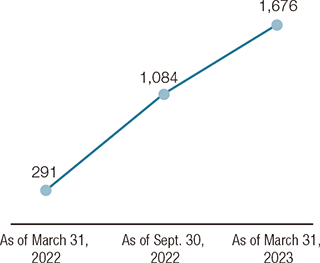

Number of cases of the SDGs declaration support service

(Supporting the preparation of written SDGs declarations)

Consulting services for business restructuring

For small and medium-sized enterprises suffering from sluggish demand and sales caused by the COVID-19 pandemic, we are working with them to analyze their strengths and weaknesses and formulate business plans. We are also providing escorted support to the enterprises to change their business formats and sectors, develop into new domains, and restructure their businesses through the use of subsidies under the subsidy program for sustaining businesses by the government with a view to the post-COVID-19 era.

We are holding individual sessions each year to provide our corporate customers with information and application support to receive subsidies, which includes explaining specific requirements and preparing application documents.

Number of subsidies granted under the subsidy program for sustaining businesses (since 2021)

| Public call | 1st | 2nd | 3rd | 4th | 5th | 6th | 7th | 8th | 9th | Cumulative total |

|---|---|---|---|---|---|---|---|---|---|---|

| Total of two banking subsidiaries | 73 | 53 | 91 | 83 | 106 | 78 | 75 | 74 | 49 | 682 |

| Joyo Bank | 44 | 30 | 49 | 46 | 67 | 50 | 48 | 44 | 25 | 403 |

| Ashikaga Bank | 29 | 23 | 42 | 37 | 39 | 28 | 27 | 30 | 24 | 279 |

Uncovering regional industries and supporting new business creation

We have the Regional Revitalization Department, and it works with Joyo Bank and Ashikaga Bank to promote regional industries.

The department and two banking subsidiaries jointly hold business conferences related to manufacturing and food for the purposes of offering our corporate customers an opportunity to have business conferences with major companies and promoting new business matching between the corporate customers of the two banking subsidiaries. We also hold a Mebuki Business Award to discover innovative and creative business plans that are latent in regions and to promote the commercialization of such plans. Through the event, we uncover regional industries and support new business creation.

Mebuki Business Award

Mebuki Food Exhibition

Dealing with a lack of successors and aging of business owners

【Business succession/M&A】

Business owners of local small and medium-sized enterprises have been rapidly aging, and there has been uncertainty about the future due to the COVID-19 pandemic and soaring resource prices. These circumstances and other factors have heightened the sense of urgency more than ever before among business companies regarding business succession issues.

The Group considers business succession/M&A, which are major turning points for its corporate customers, to be the key timing of providing escorted support, and assists them with the smooth succession of their businesses to successors through the planned development of successors, transfer of company shares, consolidation of dispersed shareholdings, etc. The Group also provides support according to its corporate customers’ circumstances and needs. For example, the Group can provide support for third-party succession such as M&A in cooperation with an external expert team and other organization. The Joyo Capital Partners Co., Ltd., an investment firm of the Group, and a fund managed by Wing Capital Partners, Ltd. can also temporarily hold all company shares.

(Number of companies)

| FY2018 | FY2019 | FY2020 | FY2021 | FY2022 | |

|---|---|---|---|---|---|

| Joyo Bank (support for business succession) |

2,728 | 949 | 1,031 | 820 | 839 |

| Joyo Bank (support for M&A) |

285 | 306 | 427 | 520 | 373 |

| Ashikaga Bank (support for business succession) |

918 | 920 | 1,279 | 954 | 1,415 |

| Ashikaga Bank (support for M&A) |

408 | 395 | 570 | 690 | 325 |

【Personnel introduction】

Securing human resources is a common management issue for many companies. We are committed to meeting our corporate customers’ human resource needs in a meticulous and prompt manner and strive to help solve a wide range of recruitment issues in a variety of industries and sectors including manufacturing, service, and retail.

We also help our corporate customers secure senior management members and specialized personnel needed to solve management issues by using our job database and directly introducing candidates for senior management members from our banks.

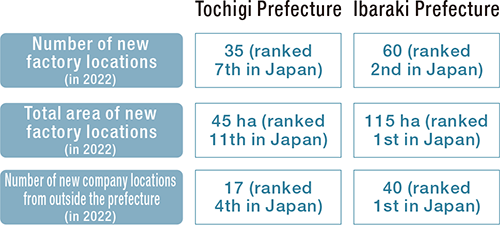

Initiatives to promote business attraction

Ibaraki Prefecture and Tochigi Prefecture are adjacent to the Tokyo metropolitan area and have well-developed high-speed transportation networks, including railroads and highways, making the prefectures ranked among the top prefectures in Japan in terms of the number of new factory locations, the total area of factory locations, and the number of company locations from outside the prefectures. The prefectures are attractive to companies as it is very convenient for their employees to commute and for logistics. New business expansion into the prefectures is expected to create jobs and increase demand for local companies’ products and services, thereby stimulating the local economy.

Ibaraki Prefecture has been working diligently to promote business attraction. The prefecture has been top-ranked in Japan for the past decade in terms of the total area of new company locations and the number of new company locations from outside the prefecture. Joyo Bank formed Bridge Business Team specialized in promoting business attraction within the Consulting Business Division. The team works with Ibaraki Prefecture and its municipalities to attract companies.

Specifically, the team and prefecture collect and provide information on supply chains, including factories and logistics facilities, and introduce suitable locations to companies. The team and prefecture also provide support and advice to solve various issues related to business expansion into the prefecture, for example, helping companies secure human resources, introducing potential local business partners, and securing housing for companies’ employees.

Ashikaga Bank participates as a member in the Tochigi New Factory Locations Development Committee to promote business attraction and the retention of companies in Tochigi Prefecture. The bank introduces industrial parks and provides other information to its corporate customers located outside the prefecture. If a corporate customer shows interest, staff of the bank and local government together visit the customer. In this way, the bank and local government actively work together to promote business attraction. The bank also cooperates with Tochigi Prefecture by encouraging corporate customers to exhibit booths and participate in seminars at the seminar held by Tochigi Prefecture twice a year in Tokyo and Osaka to showcase how the prefecture is suitable for company locations and the prefecture’s attractive features.

Source: the “Survey of Factory Location Trends” by the Ministry of Economy, Trade and Industry

Promoting food and agriculture

The agriculture and food sector, one of the core industries in Ibaraki Prefecture and Tochigi Prefecture, is expected to continue to grow. The Group shares know-how that its two banking subsidiaries have and uses its internal and external networks to provide optimal solutions for each of the production, processing and sales phases in the agriculture and food sector. The Group also provides more support to its corporate customers in terms of sales channel expansion and branding so that they can expand their business.

『Mebuki Food Exhibition』

We hold Mebuki Food Exhibition to help food-related business companies expand their sales channels and procure foods and to encourage interactions among participants.

A wide range of food-related business companies, including agricultural producers, food processors and wholesalers, retailers, and restaurant operators, take the opportunity to promote their products and have individual business meetings.

『Regional Banks’ Food Selection』

We jointly hold Regional Banks’ Food Selection, a food confab, with regional banks across Japan to widely distribute local foods and food products in the market.

The event offers a matching opportunity to directly promote the tastes and attractiveness of food products to buyers in the form of an exhibition-cum-business confab.

Initiatives to Support Global Business

Doing business overseas requires know-how and information about the countries that companies plan to enter. The Group provides meticulous support to cater to its corporate customers’ needs such as global business and expansion. Specifically, the Group holds seminars on global business and uses the overseas representative offices of the two banking subsidiaries, the financial institutions of its overseas business partners, and other related institutions and business alliance partners at home and abroad to provide local information and assistance in visiting countries, developing global sales channels, conducting trade transactions, etc.

Details of main support

| Provision of local information and research |

|

|---|---|

| Use of partner banks |

|

| Introduction of business partners and specialized institutions |

|

| Funding support |

|

| Other support |

|

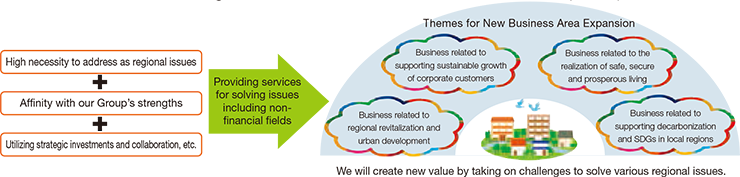

Developing New Business Areas by Leveraging the Group’s Strengths

In new business areas, we will take advantage of the Group’s strengths and alliances with external organizations in areas that could not be addressed with conventional services to solve local and customer issues.

Based on the traditional banking services area, we will expand the range of comprehensive financial services, take on new challenges, and solve regional issues from financial and non-financial perspectives. We aim to achieve sustainable growth in local communities and enhance the Group’s corporate value.

Approach to New Businesses

Deepening Life Plan Consulting

Providing services tailored to life events

Changes in the social situation, called “the 100-year life,” have diversified customers’ worries and concerns. We are working to provide a system that enables us to provide prompt and appropriate proposals and advice to our customers and channels that are easily accessible to all generations of customers, including the digital generation.

Asset building and management

We provide financial products and services tailored to our customers’ plans so that they can secure the funds they need at various stages of their lives by considering their life plans from a young age to lead a fulfilling life.

Consumption (Loans)

Housing, education, and retirement funds are the three significant funds in life. In addition to these funds, some expenses are inevitably necessary for daily life, such as marriage funds and car purchase expenses. We help our customers fund their needs with well-managed loans with explicit usage.

Security and insurance

We also offer products that are prepared for life risks, such as medical treatment expenses due to illness or injury, reduced income, death of the head of the household, and living expenses in old age for longer average life expectancy.

Asset management and succession

We have established a system capable of meeting the diverse needs of customers. We support customers’ asset management and smooth asset succession to the next generation. Specifically, we began the dedicated inheritance consulting service on Saturdays and Sundays and dedicated specialized staff in offices to address the general troubles of the elderly.

Expanding services for the digital generation

- Expand asset-building services using smartphones and the web

- Enhance functionality of banking apps (advice distribution, mutual funds, insurance, etc.)

- Expand the asset formation layer by proposing the combined use of NISA and iDeCo

- Expand the Robot advisors function

- Contribute to society through support for mandatory financial education

For the region’s future

Supporting children to be independent (Financial education)

We conduct lessons on finance to teach the importance of money and the role of banks to the next generation. We also provide financial education seminars for high school and college students to help them learn about the mechanism of the monetary economy and specific financial knowledge.

For high school students, we offer group work with lectures and simulations on life planning, asset building, and asset management up to 100. The group work includes cautions to avoid contract problems and multiple debts due to lowering the age of majority and creating a money plan that fits with the life plan.

lesson on finance

Holding “Economics Koshien Tochigi Tournament”

Every year, we hold the “All Japan High School Quiz of Finance and Economics Championship Economics Koshien Tochigi Tournament” for the purpose of providing opportunities to high school students to learn the mechanism of monetary economy easily and in a fun way. (Ashikaga Bank)

Employees’ efforts to contribute to local communities

Initiative for contributing to communities by employees

Through various volunteer activities such as participation in regional events (e.g. festival in community), cleaning activities, collection of recycling resources and environmental conservation, etc., we assist local communities’ activities.

Organizations in head office

We established specific organizations in each head office named “Joyo Volunteer Club” at Joyo Bank and “Ashigin You-I Activities Promotion Office” at Ashikaga Bank, to assist various activities by employees for contributing to communities.

Joyo Volunteer Club : Established in October 1994

Ashigin You-I Activities : Started in August 1990

Participation in local community events

|

|

| Minami-Koshigaya Awa Odori festival (Ashikaga Bank) |

Mito Komon festival (Joyo Bank) |

various volunteer activities

|

|

| Katsuta marathon volunteer (Joyo Bank) | cleaning activities (Ashikaga Bank) |

other

|

|

| pull-top collection (Ashikaga Bank) | eco-cap campaign (Joyo Bank) |

Contribute to local communities through donations

Subsidy to nonprofit organizations

Donations to nonprofit organizations, etc. through underwriting private bonds of customers with donation scheme

When customers issue private placement bonds, we use a portion of the fees received to donate books and funds to cover operating expenses to local schools and organizations working toward SDGs.

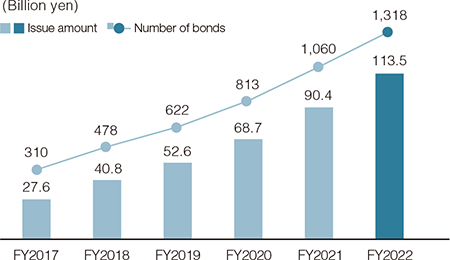

Issuance of private placement bonds with donation scheme (Cumulative total: Bank Total)

Empowering Local SDG Projects with ESG Funds

Through the Global ESG Balance Fund, an investment trust handled by Joyo Bank and Ashikaga Bank, part of the trust fees received by Nomura Asset Management Co., Ltd., the investment trust management company, is contributed in the form of a corporate version of Hometown Tax Donations. The donations are utilized to support SDGs-related local businesses in Ibaraki Prefecture and Tochigi Prefecture.

Dedication from the Donation Course of Shareholder Benefit Program

Funds from the Donation Course of the Shareholder Benefit Program are dedicated to environmental protection organizations. The donations support global environmental conservation activities, greening promotion in Ibaraki Prefecture, and environmental conservation projects in Tochigi Prefecture.

- Corporate Information

- IR & SR

- ESG

- Financial Statements & Integrated Report / Financial Data(Annual Report)