- home

- Sustainability / ESG Information

- Policies / Guidelines, Long-term KPIs, Governance Structure

Policies / Guidelines, Long-term KPIs, Governance Structure

Policies / Guidelines

Recognizing issues about sustainability as important management agendas, we have formulated and been proactively engaged in the Group Sustainability Policy with the aim of achieving both sustainable growth and corporate value enhancement of the Group while solving the issues of and realizing the sustainable growth of local communities.

In addition, to clarify our initiatives regarding Environment, Human Rights, and Diversity, the Group has formulated the Group Environmental Policy, Group Human Rights Policy, Group Diversity Policy, Environmentally and Socially Friendly Investments and Loans Policy, and Procurement and Purchasing Guidelines to operate its business based on these policies.

Mebuki Financial Group Sustainability Policy

Based on the Mebuki Financial Group Philosophy “Together with local communities, we will continue to build a more prosperous future by providing high-quality comprehensive financial services,” Mebuki Financial Group and its Group companies will support solving issues in our regions, while contributing to the achievement of sustainable growth of local communities as well as the improvement of our corporate value.

Group Environmental Policy

Under the “Group Environmental Policy” to reduce the environmental impact of its own corporate activities, Mebuki Financial Group recognizes that environmental issues, including climate change, are so critical that we have been promoting decarbonization and various other environmental conservation initiatives. For more information on the Group Environmental Policy, please visit:

Group Human Rights Policy

Mebuki Financial Group has established the Group Human Rights Policy to respect the basic human rights of all stakeholders and has pushed forward with the initiatives to respect human rights by paying attention to how the corporate activities of our borrowers and suppliers (supply chain) negatively affect human rights. For more information on the Group Human Rights Policy, please visit:

Group Diversity Policy

Mebuki Financial Group has established the Group Diversity Policy so that executives and employees with diverse abilities and personalities can maximize their ability to think and act flexibly, and we have been strengthening and accelerating our efforts to ensure diversity.

For more information on the Group Diversity Policy, please visit:

Environmentally and Socially Friendly Investments and Loans Policy

Concerning investments and loans to particular sectors that could have a negative impact on the environment and society, Mebuki Financial Group has established the Environmentally and Socially Friendly Investments and Loans Policy and sought to reduce and prevent their impact on the environment and society.

For more information on the Environmentally and Socially Friendly Investments and Loans Policy, please visit:

Procurement and Purchasing Guidelines

Aiming for a sustainable society, Mebuki Financial Group has established the Group-wide Procurement and Purchasing Guidelines to procure and purchase goods and services necessary for its business activities, and is engaged in responsible purchasing activities in consideration of the environment and society. We also make these guidelines publicly available and work with our suppliers on collaborative efforts.

For more information on the Procurement and Purchasing Guidelines, please visit:

Long-term KPIs for Sustainability

We aspire to realize sustainable local communities and enhance corporate value, and thus has set Long-term KPIs for sustainability in order to clearly define our basic stance and goals related to sustainability. As regional financial institutions, we will strengthen our efforts to solve the issues of local communities and contribute to realizing sustainable local communities by achieving the long-term KPIs.

| Sustainable finance goals |

Mebuki Financial Group will promote sustainable finance in order to contribute to the realization of sustainable local communities through the provision of financial services to our customers.

|

|---|---|

| CO2 emission reduction target (Scope 1, 2) |

Mebuki Financial Group will reduce its own CO2 emissions through its business activities and accelerate its contribution to realizing a decarbonized society and sustainable regional growth.

|

| Ratio of female employees in manager positions or higher |

Mebuki Financial Group strives to improve organizational productivity and support employees’ work-life balance in order to promote mutual understanding among employees and allow them to fully demonstrate their abilities. One particularly important theme is accelerating the active participation of women in the workforce.

|

Governance Structure for Sustainability

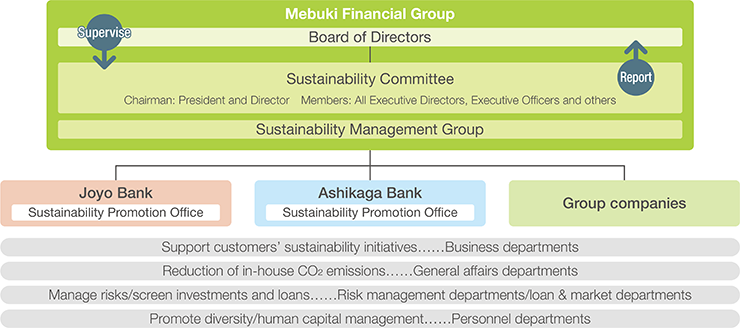

Recognizing sustainability issues as important management issues, Mebuki Financial Group has established a governance structure centered on the Sustainability Committee with supervisory functions performed by the Board of Directors and others.

Supervision by the Board of Directors

The Board of Directors supervises sustainability-related agenda items (policy and target setting, progress of initiatives, and other items). We have built a structure in which the Board of Directors can supervise the Group’s sustainability initiatives and assessments of risks and opportunity by discussing and reporting the details of deliberations at each meeting of the Sustainability Committee to the Board.

Roles of the management in sustainability

The President and Director is responsible for sustainability matters. As the chairman of the Sustainability Committee, the President and Director also assesses the impact of sustainability issues and responses on the business, develops countermeasures, sets targets, and controls the achievement management.

Sustainability Committee

To uniformly deliberate and manage the development of the Group’s basic policy on sustainability and the progress of initiatives related to sustainability issues, as well as to promote such sustainability initiatives, the Group has set up the Sustainability Committee with the President and Director serving as its chair.

The committee comprises all Executive Directors and Executive Officers, as well as the General Managers of the Corporate Planning Department, Corporate Management Department, and Regional Revitalization Department. When necessary, the presidents of Group subsidiaries and general managers of departments in charge of subsidiary banks are invited to committee meetings. The committee discusses, on a company-wide level, environmental issues such as climate change and biodiversity, social issues such as human rights, as well as human capital and other sustainability-related matters. The committee met six times in fiscal 2024.

Sustainability-related sections

The Group has established the Sustainability Management Group to act as the secretariat of the Sustainability Committee, as well as for planning, formulating, and managing functions for sustainability strategies. It also makes suggestions to the committee on Company-wide sustainability matters.

Coordination and control within the Group

The Group has established a Sustainability Promotion Office in both Joyo Bank and Ashikaga Bank, which are our core business companies, in order to enhance the effectiveness of the matters discussed by the Sustainability Committee. In addition to both of these subsidiary banks, our other Group companies utilize their respective functional meeting bodies to collaborate with the Sustainability Committee and Sustainability Management Group in order to ensure the overall control of the Group companies.

Risk management

The Group has positioned risk management as an important initiative to enhance corporate value and has established an ALM/Risk Management Committee. The ALM/Risk Management Committee, the Risk Management Departments of the subsidiary banks work with the Sustainability Committee to monitor and reassess sustainability risks, and narrow down important risks, which are then reflected in the Group’s strategies.

Status of audit

The Sustainability Committee is attended by full-time Audit and Supervisory Committee Members in an auditing capacity. The details of the discussions held are reported by the full-time Audit and Supervisory Committee Members to part-time Audit and Supervisory Committee Members at the Audit and Supervisory Committee to share information prior to the reporting of business execution at the Board of Directors. In addition to discussions at Audit and Supervisory Committee meetings, part-time Audit and Supervisory Committee members express their opinions at meetings of the Board of Directors as necessary.

- Corporate Information

- IR & SR

- Sustainability / ESG Information

- Financial Statements & Integrated Report / Financial Data(Annual Report)